On the heels of some chaotic trading in the gold, silver, stock and bond markets last week, after the Fed decision not to taper, today top Citi analyst Tom Fitzpatrick sent King World news 3 amazing gold and US dollar charts. Fitzpatrick had previously indicated to KWN that he expects a massive 150% surge in gold, and a staggering 300% move higher in silver. He also believes the Fed’s credibility has been severely damaged by their decision not to taper. Below are his 3 astonishing charts & comments about what to expect next from the metals.

Eric King: “Tom, we will get to gold and the US dollar in just a minute, but first your thoughts in the aftermath of the Fed decision not to taper?”

Fitzpatrick: “The whole of the market expectation, as guided by the Fed, was that we were going to see some tapering of some sort. As we saw data deteriorate going into the Fed meeting everybody thought that they were going to reduce, but nobody was ready for the ‘non-move.’….

“I think that if you look at the reaction afterwards, some of it was fairly logical. We saw dollar weakness, and we’ve seen yields start to push their way lower. But one of the things that now has people concerned is: Despite the initial strong move in the equity markets, why have the equity markets performed so badly thereafter?

Our view is that by not doing anything, after having given this very strong guidance that they were in fact going to taper, what the Fed injected into the financial markets is a large degree of uncertainty. And if there is one thing the equity markets dislike more than anything else, it’s uncertainty. Therefore, the way you are seeing stocks trading at the moment is a reflection of that uncertainty which has now been injected into the market.”

Eric King: “Tom, the US dollar broke to the downside after the Fed announcement. Can you talk about the action in the dollar?”

Fitzpatrick: “Yes. We expected short-term weakness in the dollar prior to that meeting, and the Fed decision not to taper just reinforced that anticipated weak action. But we have broken some important levels in terms of the Dollar Index. Our sense is this weakness might go on for a little bit longer. We don’t believe this is a change to the longer-term trend, where we expect the dollar to outperform most of the other fiat currencies.

But in the near-term, especially in the weeks ahead, and given the decision from the Fed, our view is that we will see continued weakness in the dollar through October.”

Eric King: “Where does that leave us as far as the gold market, Tom?”

Tom Fitzpatrick: “You know that we have always been of the view that the down-move in gold to the $1,180 area was the end of the much larger correction in gold. But we are also watching the dynamics of the action in the equity markets.

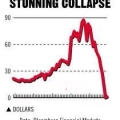

We are looking at how gold performed during the stock market collapse during the 1973 – 1974 time frame. Gold went up dramatically during that market collapse. You can also track the next strong rally in gold very closely to the period when the subsequent market rally ran out of steam in 1976 (see chart below).

See the rest of the story at KING WORLD NEWS