NOTE: Commentary by Tyler Durden at ZeroHedge

CNBC just aired a fascinating segment that pitted anchors Mandy Drury and Brian Sullivan (squarely in the markets-are-going-up-and-the-world-must-be-rosy camp) against a more skeptical (“it’s all short-covering” – and he’s right at the margin) Herb Greenberg and an awfully fact-based reality agent – Peter Boockvar.

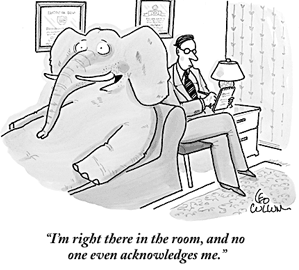

The entire 5 minutes were a perfect reflection of the battle in the markets of the last few years – that of market wisdom and the facts versus the blind optimistic ignorance of watching (and trusting) a ‘market’ number (in this case the Dow Jones Industrial Average Index) rise day after day and not caring why – until – as Peter Boockvar so eloquently notes you have your 401(k) cut in half twice in a decade.

Well worth taking the time to witness the cognitive dissonance of believing the market strength is unrelated to the Fed and yet a Fed unable to Taper even a few billion for fear of repercussions… as Boockvar notes, “there is 0% chance this ends well.”

Video Source: CNBC