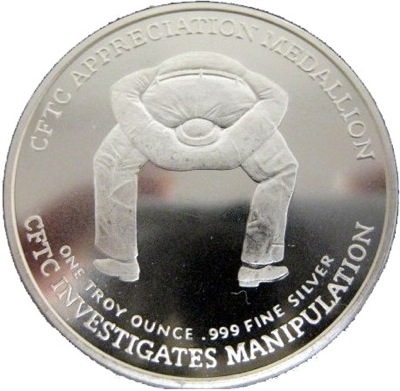

It is somehow fitting that on the day when even more undisputed evidence is revealed [6], surrounding the most brazen market manipulation scheme in history – one involving the “unmanipulable” Libor benchmark rate which serves as the foundation for hundreds of trillions in interest rate sensitive instruments – that the CFTC would also come out moments ago, and announce that in its long-running investigation of alleged manipulation in the silver market… there is absolutely nothing wrong.

Reuters reports [7]:

The U.S. Commodity Futures Trading Commission on Wednesday said it has closed its long-running investigation into complaints about manipulation in the silver markets, and is not recommending charges.

The CFTC publicly confirmed the probe in September 2008. At the time, the agency had received complaints about whether the silver futures contracts traded on the Commodity Exchange Inc (COMEX) were being manipulated.

“Based upon the law and evidence as they exist at this time, there is not a viable basis to bring an enforcement action with respect to any firm or its employees related to our investigation of silver markets,” the CFTC said in a statement.

Just like that, case closed. Because while every bank was involved in such wholesale manipulative activity as Libor, nobody, nobody dared to manipulate by banging the close, open and everything in between, or slam and take out the entire bid stack in key inflection points, something as simple as paper silver.

And now, we go back to everyone’s favorite CFTC “good cop” Alexander Godunov [8]Bart Chilton who will make the case how aggressively the CFTC pursue every and all instances of precious metal manipulation.