ZeroHedge News

A Secret Service agent assigned to protect Vice President Kamala Harris got into a physical altercation with several other agents Monday morning around 9 a.m. near Joint Base Andrews, located near Washington DC.

The agent in question was immediately "removed from their assignment," the Secret Service told the NY Post.

"A US Secret Service special agent supporting the Vice President’s departure from Joint Base Andrews began displaying behavior their colleagues found distressing," said Anthony Guglielmi, chief of communications.

According to CBS News, "the agent spouted gibberish, was speaking incoherently and provoked another officer physically," and "pushed the special agent in charge while they were near the lounge of Joint Base Andrews."

They were immediately handcuffed and detained by other Secret Service agents who intervened, and ambulances were called to the scene. An initial medical evaluation concluded that there was no indication of substance abuse.

The USSS remains in a temporary holding pattern until further information becomes available, the sources said. After the agent receives additional medical attention and further evaluation, it will be determined if they can return to work. An internal review will be conducted and the USSS will assess if the agent's top secret security clearance will be removed for medical or disciplinary reasons, sources explained. -NBC News

Harris was at the Naval Observatory at the time according to the USSS, and the incident had "no impact on her departure from Joint Base Andrews" on the day in question.

According to RealClearPolitics journalist Susan Crabtree, "there are DEI concerns among the USSS community about the hiring of this agent," adding "Other agents and officers within the USSS are asking questions about the agent’s hiring process, whether the USSS did enough to look into the agent’s background and monitor the agent’s mental well-being…"

Other details: Sources say the agent in question was acted erratically upon showing up for a traveling shift at Joint Base Andrews. The agent ended up tackling the Senior Agent in Charge of the VP detail, got on top of him and started punching him. At this point, I'm told, the…

— Susan Crabtree (@susancrabtree) April 24, 2024

Authored by Jeffrey Tucker via The Epoch Times,

Smart people know to avoid fallacies.

One of them is known as the fallacy of post hoc ergo propter hoc.

It’s Latin for “after this, therefore because of this.”

The classic example concerns the rooster and the sunrise.

Every morning before the sun comes up, the rooster does his crazy crowing routine, waking up everyone around. Shortly after, the light begins to appear on the horizon.

If you knew nothing else, and you watched this happen over and over, you might conclude that the rooster is causing the sun to rise.

Of course, this is testable. You could kill the rooster and see what happens. The sun still comes up. But wait just a moment. Just the fact that this one rooster is dead doesn’t mean that all roosters are gone. Some rooster somewhere is crowing and causing the sun to rise. So your little experiment doesn’t disprove the theory.

What a conundrum, right?

If someone is convinced that a bird is controlling the sun, there is probably no way to convince him otherwise.

We can laugh at this example. How can someone be so dumb? Actually, this basic fallacy affects all science in all times, all places, and all subjects. The presumption that a regular pattern showing something happens and then something else happens with regularity implies causation is baked into human thinking. Now and always.

It’s a fallacy, meaning that it is not necessarily true. It could be true, however, subject to serious investigation. And therein lies the real problem. We need to figure out what causes what. But discerning causal agents from accidental ones is the biggest issue in all thinking.

The need to know is baked into what it means to be a rational creature. We just cannot help ourselves. That’s why this fallacy persists everywhere.

There is also the famous case of malaria. It was once believed that infections were worse at nightfall, so the theory was that it was caused by cold air at night. Not crazy, right? Except that the real reason was that the mosquitoes came out in the evenings. They were the real culprit. But a bad theory based on fallacy prevented many people from seeing it.

My goodness, we were overwhelmed by this during the COVID-19 experience. The fake science was overwhelming.

Day after day, we saw loads of fake science of this sort being dumped on the world.

Look, California’s cases are down and California bans gatherings, therefore coercive measures are controlling virus spread!

Not so fast.

These factors could be completely unrelated. We might not even have good data on infections at all. Those are subject to testing (accurate or not) and might be completely wrong on a population level. Even if the data were correct, the low infections could be caused by weather, prior immunity, or something else that we have not considered.

Early on, I can recall looking at these amazing real-time charts of infections and deaths and believing that I had a window into reality. Several times, I even posted things along the lines of “See, Arizona has achieved herd immunity,” without understanding that the data were wildly inaccurate and subject to testing, reporting, and a host of other factors. Even the data were suspect: Misclassification was rampant.

And here too, the fallacy of post hoc ergo propter hoc bit everyone extremely hard. But most of us went along with it.

So crazy did it all become that people including bureaucrats at the Centers for Disease Control and Prevention started inventing nutty theories such as that masking protects against virus spread, which science had long proven to be untrue. It became even crazier: You can sit without a mask but walking and standing causes viruses to spread, so that’s when you have to wear a mask!

Absolutely nuts!

It was the same after vaccination.

Countless famous people took to social media to announce they had COVID-19 but it was a mild case thanks to the vaccine. There is simply no way they could know that. They knew for sure that they had the vaccine and they knew for sure that their case of COVID-19 was mild. But believing that one caused the other was simply a matter of faith. It might have been mild regardless. It might have been milder. As time went on, we encountered many studies showing that more vaccination was associated with more infection. Did one cause the other? It’s hard to say.

And yet vast numbers of vaccine studies in the past several years have been affected by this problem. Particularly vexing is the problem of the “healthy user bias,” which is that people who were vaccinated tend to be more compliant and conscientious in other ways too, which meant that initially, it seemed like they had better health outcomes from COVID-19 vaccination, but the results were actually attributable to this bias.

This was revealed in later studies. But the problem of discerning cause and effect from random noise still persists.

The field of medicine has long dealt with this problem. We are mortified that the practice of bleeding patients persisted for centuries even up to the 19th century. How could they have been so stupid? Well, they had a theory that disease was caused by bad humors in the blood so it needed to be drained. Then they observed that the patient got better.

Well, the patient might have gotten better anyway and even faster without bleeding. But it took many centuries to finally realize that. Many non-allopathic medicine people had been screaming about this issue for a long time, but they were ignored as cranks. That’s because bleeding was a conventional practice endorsed by the people with the most professional prestige.

Once you see this fallacy at work, you cannot unsee it. It’s everywhere in medicine but also in economics, health, horticulture, law and sociology, and all the physical world sciences. The gun debate is a good example. There is high crime and there are lots of guns, so people conclude that the guns cause the crime, whereas the presence of guns might simply be a response to crime and a means of protection. Without them, the crime would be far worse.

The fallacy in question drives vast amounts of politics today. There is a tendency to blame any existing president for all existing economic conditions, but the real cause might date further back in time. Still, nearly every debate follows the same lines: This happened; therefore, his actions or inactions caused it. It could be true or it might be the same as the rooster and the sunrise.

We flatter ourselves now that we are beyond such fallacies. They belong only to the superstition-ridden ages of the past. That’s complete nonsense. We are probably more inundated by this fallacy now than ever. Whatever it is that people trust and believe in at any particular time is what people identify as the key to curing whatever malady is around.

Today, people believe in pharmaceuticals. Whatever the issue is, it can be solved by a new lab-created potion. As a result, we are soaked as a society in these, even though the evidence for many of them is scant. The more you look at, for example, the effect of psychiatric drugs, the less it becomes clear whether and to what extent these help or actually may worsen the real problem.

It’s even true with antibiotics. All parents use amoxicillin on childhood ear infections today. But my grandmother swore by putting warm mineral oil in the ear and avoiding conventional meds completely. It took me only a few minutes to discover a 2003 study that randomized whether kids got herbal oils with or without antibiotics. Results: no difference.

The implications are profound. We are so attached to pharma and allopathic strategies that we might be overlooking vast naturopathic and homeopathic methods that work better.

Seizing on one solution and sticking with it prevents the human mind from being creative about other possible and better solutions. Generations can go by in which fallacies rule the day. We can laugh about roosters and sun, bleeding and disease, dances and rain, but how many times do we commit these fallacies in our world today but our dogmatic attachments prevent us from seeing them?

Yemen’s Iran-linked Houthis have announced new aggressive actions in the Gulf of Aden and Red Sea regions, saying late Wednesday that projectiles were launched against more US and Israeli-owned commercial vessels, and that a US warship was also targeted. This follows a period of relative quiet this month.

Houthi military spokesman Yahya Saree said in a video address that an antiship ballistic missile was launched against the Maersk Yorktown cargo ship in the Gulf of Aden, resulting in a direct hit.

The US military subsequently confirmed the fresh attack on the "US-flagged, owned, and operated vessel with 18 US and four Greek crew members"; however, the statement indicated no casualties or damage. The projectile may have exploded near the ship without hitting it.

"There were no injuries or damage reported by US, coalition, or commercial ships," US Central Command (CENTCOM) said in the statement, without indicating whether there was any level of an actual direct strike on the ship. Commenting further, Maritime Executive details:

They received a report from a vessel of an explosion in the water approximately 72 nautical miles southeast of the port of Djibouti. The statement only said that there had been an explosion "at a distance," and that the crew and vessel were reported safe.

CENTCOM further described that within hours of the attack on the Maersk Yorktown, US forces "successfully engaged and destroyed" four drones over Yemen.

The government of Greece this week also said it has been engaged in fresh counter-Houthi actions:

The Greek Ministry of National Defense said on Thursday that one of the country’s military ships serving in the European Union’s naval mission to counter the Houthis in the Red Sea intercepted two drones launched towards a commercial ship from Yemen.

The United Kingdom Maritime Trade Operations (UKMTO) had earlier confirmed an incident some 72 nautical miles (133km) southeast of the port of Djibouti in the Gulf of Aden.

These kind of Houthi attacks in the Red Sea and off Yemen's coast have somewhat waned of late, compared with the near daily intensity of the prior months, and some analysts have speculated that the Houthis are running low on their missile and drone arsenal.

Prior to Wednesday's new incidents, the last significant Houthi attacks prior to that came two weeks ago. This could also be due to the prospect of some kind of Red Sea truce negotiations which have been reported of late.

UKMTO WARNING INCIDENT 065 - ATTACK#MartimeSecurity #MarSechttps://t.co/fX3hWupi7g pic.twitter.com/mQ3nmxwGj7

— United Kingdom Maritime Trade Operations (UKMTO) (@UK_MTO) April 25, 2024

A Yemeni official has been cited in regional outlet The National as saying, "In response to the Yemeni group's attempts to target Israeli ships, the US has not only resorted to military action but also sought to convey proposals that would incentivize the militants to stop their attacks."

“Messages containing incentives were sent from the Americans to Sanaa in recent weeks. These messages were delivered through envoys and mediators, including western officials, with the Omani capital, Muscat, also playing a significant role," the source added.

It's not just record capital gains taxes that Americans have to look forward to if they choose "4 more years, pause" of the senile occupant in the White House: As Epoch Times' Jeffrey Tucker reports, property taxes are also about to soar.

Below we excerpt from his latest report on where the Biden tax tsunami sill strike next:

Get Ready to Be Hammered by Property Taxes

There have been very few points of financial solace in the past few years apart from rising financial markets. Part of that has been an incredible increase in home valuations. This comes from inflation, yes, but also from shifts in supply and demand for home purchases. Demand is as it always was but realizing it is another matter.

The problem is on the supply side. In most places around the country, homes are not going on the market at the same and predictable pace they once were. This is for reasons of soaring costs of new mortgages. Many homeowners purchased back when interest rates were absurdly low and negative in real terms, perhaps 2 or 3 percent.

Selling now means paying huge capital gains taxes and then applying for a new mortgage at 7.5 percent. The implications of that seemingly small change are actually gigantic, and making it work without paying drastically more in monthly bills means moving to a cheaper area of the country or downsizing the quality and size of the home.

Rather than make that choice, many homeowners are stuck living right where they are even if they would prefer some other job or home elsewhere. They are frozen in place but, hey, at least these people have homes that they own, right?

Not only that but the valuation that you see on Zillow is going up and up. Yay!

Not so fast. In the United States, you pay property taxes on your home. This reality gives rise to the perennial question: do you really own your home if maintaining that title requires paying huge property taxes on the place annually? If you don’t pay, the house is taken over by the state, period. It feels a bit like renting doesn’t it? Indeed, the difference between renting and owning can get a bit blurry.

Property taxes are the way schools are funded in the United States generally speaking and with some exceptions. Taxes are organized according to school districts, the lines of which are extremely strict. The identical home one street from the next can have a big difference in price based entirely on market perceptions of quality of the schools in the relevant district.

This is a major reason why “school choice,” whereby anyone from any district can attend any other, has never made much progress politically in the United States. It means a tremendous scrambling of ownership valuations. No one wants that.

You pay these taxes whether you use the schools or not and whether or not you even have children at all. That’s what makes them public schools. The public shares in the expense but the reality is that it is not the public but just property owners from one district to another, with subsidies added by state governments and the federal government, plus “booster” organizations formed by parents.

If you are living in a district and stuck in a home because you cannot move due to expense, you are still stuck paying taxes regardless. These are assessed annually based not on the price at which you purchased the home but on the value of the home at present market value. That doesn’t seem fair either. Why should you continue to have to pay more and more in taxes based on valuation that you are not actually seeing in any kind of profit?

You are a sitting duck, forced to cough up whatever the assessors and tax collectors decide you have to pay.

This year alone, we are seeing huge increases in market valuations that are reflected in taxes you have to pay whether you use public schools or not. The taxes on many mid-sized homes in Texas, for example, are going up thousands of dollars right now. The fear in Georgia is so large that some activists have put on the ballot an initiative to cap property taxes to insulate them from market pressures.

Adding to the frustration here is the terrible reality of school closures from 2020–2022. Even if you wanted to use the schools, you could not because the authorities said that there were viruses in the schools that the children would spread and bring home. There was never any evidence at all that schools were uniquely guilty of viral spread but the perception was used as the excuse to force everyone into Zoom school, which taught the kids nothing.

We are now faced with years of learning loss that keeps getting worse, not to mention soaring absenteeism. The routines of an entire generation were disrupted and not returned to normal.

Continue reading at Epoch Times

Authored by Charles Hugh Smith via OfTwoMinds blog,

Behind the facade of normalization, even high-income lifestyles have been ghetto-ized.

Consider the defining characteristics of a ghetto:

1. The residents can't afford to live elsewhere.

2. Everything is a rip-off because options are limited and retailers / service providers know residents have no other choice or must go to extraordinary effort to get better quality or a lower price.

3. Nothing works correctly or efficiently. Things break down and aren't fixed properly. Maintenance is poor to non-existent. Any service requires standing in line or being on hold.

4. Local governance is corrupt and/or incompetent. Residents are viewed as a reliable "vote farm" for the incumbents, even though whatever little they accomplish for the residents doesn't reduce the sources of immiseration.

5. The locale is unsafe. Cars are routinely broken into, there are security bars over windows and gates to entrances, everything not chained down is stolen--and even what is chained down is stolen.

6. There are few viable businesses and numerous empty storefronts.

7. The built environment is ugly: strip malls, used car lots, etc. There are few safe public spaces or parks that are well maintained and inviting.

8. Most of the commerce is corporate-owned outlets; the money doesn't stay in the community.

9. Public transport is minimal and constantly being degraded.

10. They get you coming and going: whatever is available is double in cost, effort and time. Very little is convenient or easy. Services are far away.

11. Residents pay high rates of interest on debt.

12. There are few sources of healthy real food. The residents are unhealthy and self-medicate with a panoply of addictions to alcohol, meds, painkillers, gambling, social media, gaming, celebrity worship, etc.

13. Nobody in authority really cares what the residents experience, as they know the residents are atomized and ground down, incapable of cooperating in an organized fashion, and therefore powerless.

I submit that these defining characteristics of ghettos apply to wide swaths of American life. Ghettos are not limited to urban zones; suburbs and rural locales can qualify as well. The defining zeitgeist of a ghetto is the residents are effectively held hostage by limited options and high costs: public and private-sector monopolies that provide poor quality at high prices.

Daily life is a grind of long waits / commutes, low-quality goods and services, shadow work (work we have to do that we're not paid for that was once done as part of the service we pay for) and unhealthy addictions to distractions and whatever offers a temporary escape from the grind.

We've habituated to being corralled into the immiseration of limited options and high costs; the immiseration and sordid degradation have been normalized into "everyday life." We've lost track of what's been lost to erosion and decay. We sense what's been lost but feel powerless to reverse it. This is the essence of the ghetto-ization of daily life.

Behind the facade of normalization, even high-income lifestyles have been ghetto-ized. But saying this is anathema: either be upbeat, optimistic and positive or remain silent.

What's worse, the ghetto-ization or our inability to recognize it and discuss it openly?

* * *

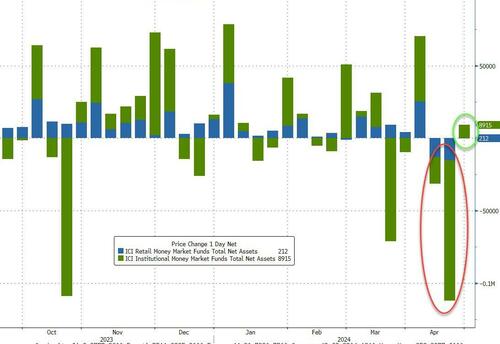

After the prior week's almost unprecedented outflows, total money market fund assets rose last week (admittedly by a modest $9.1BN), but remain below the $6TN level ($5.97TN) as tax-season draws roll off...

Source: Bloomberg

The flows into money-market fund assets through April 24 mainly on the back of inflows by institutional investors, which had led the tax-related decline the prior week. Institutions added $8.9 billion in money-market fund exposure.

Source: Bloomberg

In a breakdown for the week to April 24, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.84 trillion, a $3.97 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets rise to $1.02 trillion, a $3.15 billion increase.

Still, cash is expected to continue piling into money funds as long as the Federal Reserve keeps rates on hold - and this week has seen rate-cut expectations tumble further...

Source: Bloomberg

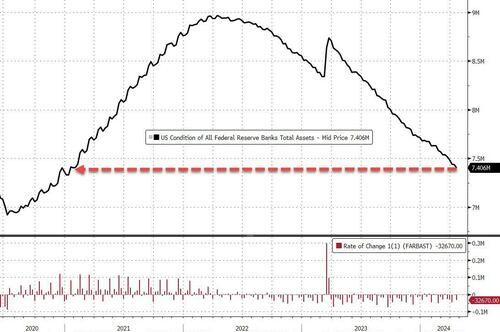

The Fed balance sheet continued to shrink, falling $32.8BN to its lowest since Jan 2021...

Source: Bloomberg

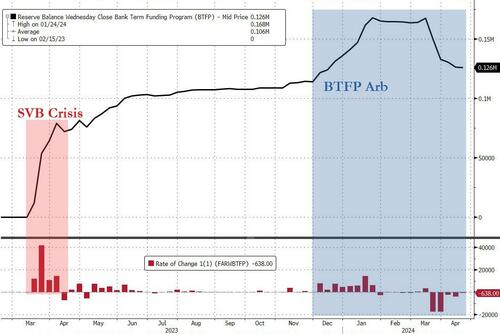

As The Fed starts discussing tapering QT, usage of The Fed's bank bailout facility (now expired but these are 12 month term loans) continued to decline (though only by a tiny $638MM), basically erasing all the late-period arb-driven inflows, leaving a huge $126BN hole in bank balance sheets still being filled by this...

Source: Bloomberg

This means the 'real' crisis money that banks used to save their souls is yet to really unwind from this bailout fund (and rates are considerably higher now than they were a year ago when the balance sheet holes were stuff with fake Fed paper - i.e. the losses are bigger).

Finally, we note that bank reserves at The Fed plunged last week and while US equity market cap has bounced a little in the last two days, we suspect the trend down (and a painful recoupling) remains a threat...

Source: Bloomberg

While there may be no rate-cuts anytime soon... will The Fed taper QT in a big enough manner to avoid that recoupling?

Authored by Eric Lundrum via American Greatness,

On Wednesday, lawmakers in the U.S. House of Representatives called for the Internal Revenue Service (IRS) to begin investigating the financial links between China and anti-Israel groups that have been protesting throughout the United States since October 7th.

According to the Washington Free Beacon, the request comes from members of the House Ways and Means Committee, who wrote a letter expressing concerns that “foreign adversaries are taking advantage of loopholes to impact American political activity with little-to-no transparency.”

One such example is The People’s Forum, a group that organized anti-Israel protests such as public school walkouts in New York City.

The group is bankrolled by Neville Roy Singham, a tech mogul with pro-China sympathies, as documented by the New York Times.

The People’s Forum urged students to chant anti-Semitic phrases, including “from the river to the sea, Palestine will be free,” which calls for the extermination of all Israelis.

Another example is The Energy Foundation, a U.S.-based nonprofit group that focuses primarily on global warming, yet operates mostly out of China and has deep ties to the ruling Chinese Communist Party (CCP).

This organization has repeatedly advocated for “green” energy policies that would hurt the United States’ energy production, to the benefit of China.

“Not only do these activities raise serious national security concerns, but they also raise questions about whether organizations like this receive foreign funding from America’s adversaries and whether the Internal Revenue Service (‘IRS’) is conducting oversight of entities like these,” said the letter sent by lawmakers to IRS commissioner Daniel Werfel.

The committee members asked if the IRS has “a definition of antisemitism in place within the agency that it considers when evaluating the claimed exempt purpose of a tax-exempt organization,” for the purposes of cracking down on such radical groups. The letter also asked if the IRS would eventually start an investigation into the various financial links between China and various domestic groups.

After the first two Mag7 companies were a study in market paradoxes, when TSLA missed across the board and soared (after guiding much better than expected) and META beat across the board but plunged (after guiding weaker than expected while boosting its spending forecast), moments ago two of the Mag7 giants, GOOGL and MSFT, both reported and this time there was far less drama: both beat, and saw their stock soaring after hours.

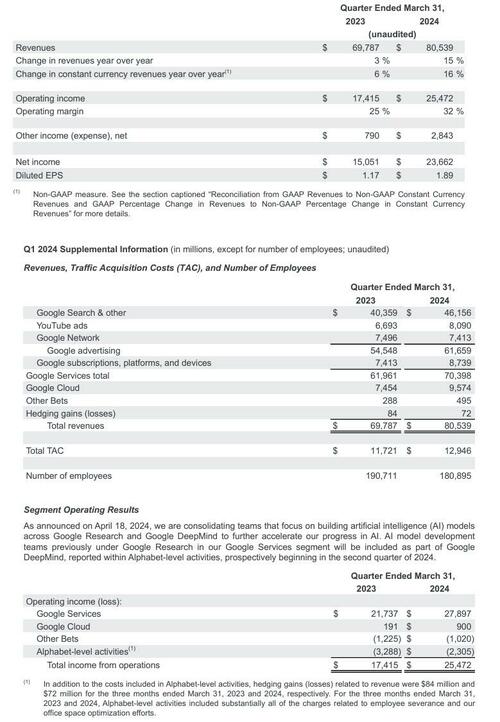

Focusing on Google parent Alphabet, Goldman said ahead of earnings that positioning here was not as excessive (at 7/10) which may be why the stock is soaring some 13% after the close on what otherwise appears to be a solid beat. Here are the details:

- EPS $1.89, beating estimate $1.53, and up more than 50% vs the $1.17 a year ago.

- Q1 Revenue $80.54 billion, beating the estimate of $79.04 billion, and up 15% YoY

- Google advertising revenue $61.66 billion, beating the estimate $60.18 billion

- YouTube ads revenue $8.09 billion, beating the estimate $7.73 billion

- Google Services revenue $70.40 billion, beating the estimate $69.06 billion

- Google Cloud revenue $9.57 billion, beating the estimate $9.37 billion

- Other Bets revenue $495 million, beating estimate $372.4 million

- Operating income $25.47 billion, beating estimate $22.4 billion

- Google Services operating income $27.90 billion, beating the estimate $24.3 billion

- Google Cloud operating income $900 million, beating the estimate $672.4 million

- Other Bets operating loss $1.02 billion, beating the estimate loss $1.12 billion

- Operating margin 32%, beating the estimate 28.6%

- Capital expenditure $12.01 billion, beating the estimate $10.32 billion

- Number of employees 180,895, down from 190,711

A quick point on YouTube: it was bought by Google in 2006 for $1.65 billion; YouTube now generates $1.65 billion of revenue every 18 days.

The results visually:

While Google's cloud numbers were stellar, with revenue rising from $7.5BN to $9.6BN, and beating estimates of $9.4BN, what investors wanted to hear was more about the company's progress on AI. This is what it had to say:

As announced on April 18, 2024, we are consolidating teams that focus on building artificial intelligence (AI) models across Google Research and Google DeepMind to further accelerate our progress in AI. AI model development teams previously under Google Research in our Google Services segment will be included as part of Google DeepMind, reported within Alphabet-level activities, prospectively beginning in the second quarter of 2024.

Like other Big Tech companies, Alphabet has been plowing money into developing artificial intelligence, a strategy that has helped drive demand for its cloud services, which saw revenue rise 28% in the first quarter. While Google remains a distant third in the cloud computing market, trailing Amazon and Microsoft, the company’s prowess in AI could help it close the gap.

Google has developed much of the underlying technology being used in the AI boom today, and has woven it into products from web search to its suite of enterprise software from Gmail to Google Docs. Yet ever since OpenAI’s ChatGPT was released in late 2022, Google has been battling the perception that it’s lagging behind Microsoft and OpenAI in rolling out new generative AI tools. The arrival of popular chatbots such as ChatGPT — which answers questions in a conversational tone rather than providing lists of links to other websites — has posed a threat to Google’s two-decade stranglehold on search. The company is struggling to compete in generative AI without cannibalizing its core profit machine.

Google has been scrambling to reassert its early lead in AI, after its early efforts were marred by embarrassing blunders, including a scandal over how its AI model Gemini handled race that forced the company to suspend image generation of people.

Commenting on the results, CFO Ruth Porat said: “Our strong financial results for the first quarter reflect revenue strength across the company and ongoing efforts to durably reengineer our cost base. We delivered revenues of $80.5 billion, up 15% year-on-year, and operating margin expansion.”

It certainly delivered, and just to make sure the market rewarded it, the company not only announced the start of new cash dividend at 20 cents...

Alphabet’s Board of Directors today approved the initiation of a cash dividend program, and declared a cash dividend of $0.20 per share that will be paid on June 17, 2024, to stockholders of record as of June 10, 2024, on each of the company’s Class A, Class B, and Class C shares.

... but also announced a new stock buyback program for $70 billion!

Alphabet’s Board of Directors today authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares in a manner deemed in the best interest of the company and its stockholders, taking into account the economic cost and prevailing market conditions, including the relative trading prices and volumes of the Class A and Class C shares.

While investors have shown they are excited about the prospects of AI, they want tech companies to continue to focus on revenue and profit in the meantime. Meta, which competes with Google in AI and also digital advertising, suffered its worst stock decline since October 2022 after reporting that it would spend billions of dollars more this year on AI efforts and projecting weaker revenue for the current quarter. For its part, Google - which does not do forecasts - paid $12BN in capex in the quarter, $1.7 billion more than estimated.

For all the hoopla about AI, search advertising remains the engine of Google’s lucrative business, and the company is facing heightened competition there, too. Meta has been seeding AI tools throughout its advertising business and Snap Inc. has also undergone a total revamp of its ad business to improve ad targeting. The digital ad market is recovering from a post-pandemic slump, buoyed by the Olympics Games this summer, but Google is increasingly vying for those ad dollars with Meta and Snap.

If consumers gravitate from Google search to the new wave of chatbots, that could imperil the company’s search advertising juggernaut, which is expected to generate nearly $200 billion in revenue this year and the bulk of Alphabet’s profit.

Cloud has been a bright spot for Google, after it first became profitable early last year. Many young AI startups are founded by former Google employees, creating a strong pipeline of cloud clients.

For now, however, these concerns were on the backburner, with GOOGL stock exploding about 12% after hours, and trading at a new all time high.

Authored by Eric Lundrum via American Greatness,

Despite the fact that Joe Biden signed into law a bill that will ban the Chinese social media app TikTok if its parent company does not sell it, his campaign will continue to use the app in the meantime.

As Fox News reports, campaign officials confirmed on Wednesday that the Biden campaign “will stay on TikTok,” even after Biden signed a massive foreign aid package which included the provision on TikTok.

The law requires ByteDance, the Chinese parent company of TikTok, to sell the app within nine months or else the app will be banned from use in the United States.

The law banning TikTok had been in the works on Capitol Hill for some time, with lawmakers on both sides of the aisle expressing national security concerns over TikTok’s close ties to the Chinese government, as well as privacy concerns regarding users’ personal data.

The provision to ban TikTok was included in the broader $95 billion foreign aid bill, which included money for Ukraine, Israel, and Taiwan.

A standalone bill on TikTok had stalled in the Senate, so Republicans simply worked the legislation into the overall aid package in order to guarantee its passage. The bill passed both houses with overwhelming support.

Whereas the original TikTok bill gave ByteDance six months to sell the app, the final version gives the company nine months to sell, thus setting the deadline after the November election.

If a sale is confirmed to be in the process, the legislation gives the company an extra three months to finalize the deal.

TikTok has refused to capitulate to the new law, repeatedly denying accusations of privacy breaches or being a national security threat.

“At the stage that the bill is signed, we will move to the courts for a legal challenge,” said Michael Beckerman, TikTok’s head of public policy for the Americas, in a memo sent to all employees on Saturday.

“This is the beginning, not the end of this long process.”

Following the passage of the law, TikTok declared the new legislation to be “unconstitutional.”

“This unconstitutional law is a TikTok ban, and we will challenge it in court,” the company said in a statement on Wednesday.

“We believe the facts and the law are clearly on our side, and we will ultimately prevail.”

“This ban would devastate seven million businesses and silence 170 million Americans,” the statement continued. “As we continue to challenge this unconstitutional ban, we will continue investing and innovating to ensure TikTok remains a space where Americans of all walks of life can safely come to share their experiences, find joy, and be inspired.”

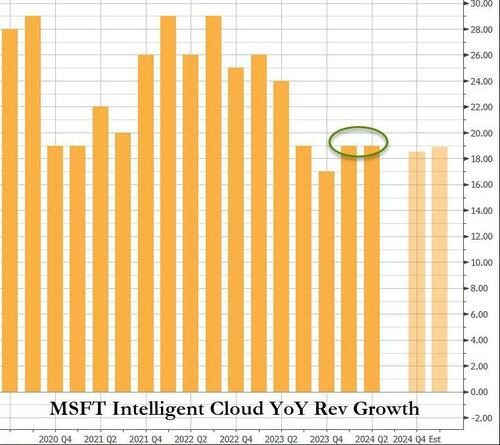

Investors can exhale after META's meltdown as MSFT just reported better-than-expected revenues in Q3 of $61.86 billion (estimate $60.87 billion).

All the business segments also beat expectations:

-

Productivity and Business Processes revenue $19.57 billion, estimate $19.54 billion

-

More Personal Computing revenue $15.58 billion, estimate $15.07 billion

With the AI-exposed segments strong:

-

Microsoft Cloud revenue $35.1 billion, estimate $33.93 billion

-

Intelligent Cloud revenue $26.71 billion, estimate $26.25 billion

“This quarter Microsoft Cloud revenue was $35.1 billion, up 23% year-over-year, driven by strong execution by our sales teams and partners,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

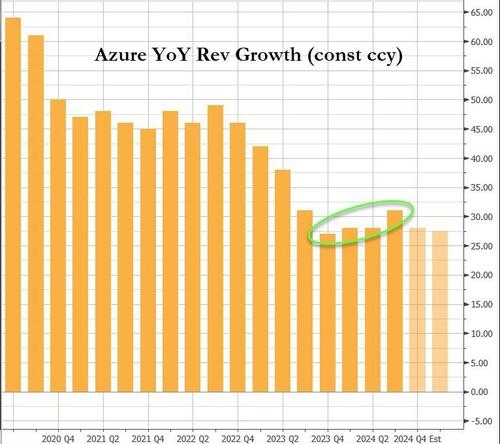

Azure revenue gained 31% in the quarter, above an average prediction of 29%, picking up slightly from the 30% growth in the previous period.

“Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry," said Satya Nadella, chairman and chief executive officer of Microsoft.

Investors are liking what they are seeing from the earnings so far with MSFT up around 5% after hours, erasing the META-driven losses during the day...

Microsoft will provide forward-looking guidance in connection with this quarterly earnings announcement on its earnings conference call and webcast.

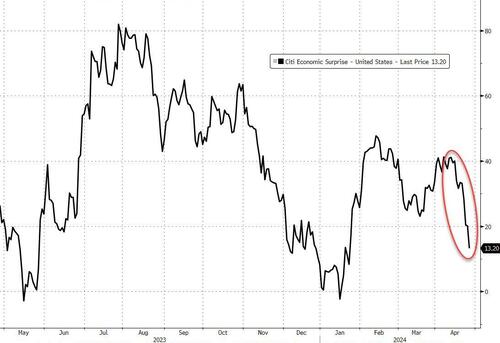

Overall, US macro data has suddenly started to disappoint (not the least of which was today's ugly GDP print)...

Source: Bloomberg

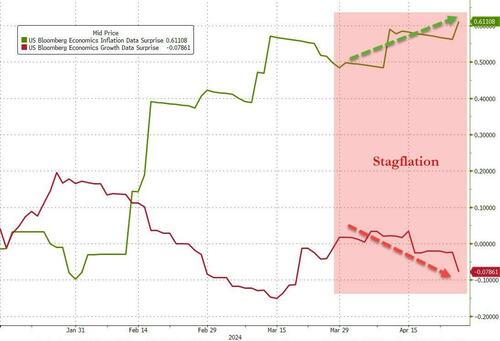

But, while 'bad news' for the economy has recently been 'good news' for stocks (enables an easier Fed), today's data 'punched that narrative in the face' with Core PCE price index in Q1 soaring considerably more than expected. And here's the problem - inflation expectations are surging at the same time as growth expectations are sliding - the nemesis of every central banker is upon us: STAGFLATION.

It's been a theme all year but recently has become so much more pronounced that not even the best 'spinners' can ignore...

Source: Bloomberg

And that sent rate-cut expectations plummeting to cycle lows (and took June completely off the table for a cut)(

Source: Bloomberg

Combine the ugly macro data with some ugly micro (META) and Goldman's trading desk noted overall flow was skewed better to sell:

LO’s driving more of the supply here with a -3% sell skew. An outlier is that we are seeing very real demand in AAPL from both HF and L/O community. META seeing very little defense from L/O . Overall activity from the group feels muted.

In the HF community we are slightly better to buy. Very notable that in macro products, short ratios are elevated to 75%. We are seeing cover buying in the Tech.

Overall, the majors were all lower close to close, but well off their knee-jerk lows from the GDP/PCE data... The Dow was the laggard on the day (with IBM & CAT the biggest points drag). The rest of the majors were all equally pummeled (though we do note that Nasdaq is still up over 2% on the week)...

The initial puked slammed The Dow and Nasdaq back below their 100DMAs and the ramp-fest back up to that critical technical level, but that couldn't hold into the close...

As you'd expect, given META's meltdown, the basket of MAG7 stocks was ugly out of the gate - and ended red - but staged a decent comeback during the day...

Source: Bloomberg

And 'most shorted' stocks followed a similar trajectory - squeezing higher after an ugly open...

Source: Bloomberg

Tech stocks overall ended marginally lower, Energy outperformed while Real Estate and Healthcare lagged...

Source: Bloomberg

Treasuries were clubbed like a baby seal on the macro data and pulled back only modestly during the day with the short-end and belly underperforming the long-end...

Source: Bloomberg

2Y Yields broke above 5.00% AGAIN... but were unable to close above it AGAIN...

Source: Bloomberg

The dollar spiked immediately higher on the GDP data, but as the day wore on, the dollar bled back its gains to end lower on the day...

Source: Bloomberg

Gold prices rallied on the day, shrugging off the vol in the dollar...

Source: Bloomberg

Bitcoin managed gain on the day after overnight weakness...

Source: Bloomberg

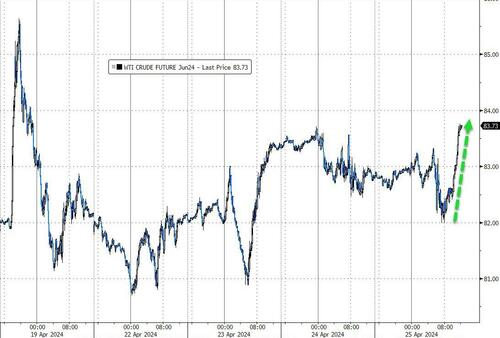

Crude prices managed solid gains after early weakness with WTI rallying back up towards $84...

Source: Bloomberg

Finally, we are down to the vinegar strokes of the week with GOOGL & MSFT tonight, and PCE tomorrow...

Source: Bloomberg

...and don't forget The Fed next week where no action is expected, but the words may speak even louder this time.

By Mish Shedlock of MishTalk

Why is the choice between shutting down the border and no controls at all? And what about demographics? Fertility rates?

Immigration Talks We Should Be Having

Eurointelligence discusses the Immigration Talks We Should Be Having.

The ideas also apply to the US.

Last week, the European Commission set out its ambitions to strike a deal with Lebanon, to stop asylum-seekers reaching the EU from there. Giorgia Meloni [Italy’s Pime Minister] now spends so much time in Tunisia, where the EU signed another agreement to limit migration, that she should consider buying a time-share in Bizerte.

Fabio Panetta, the Banca d’Italia’s governor, recently made a welcome intervention on this. He made a point which you do not hear very often: that without more immigration, the EU will sink demographically. That will mean both its economic and fiscal situation becoming unsustainable. According to Panetta, a common EU-level policy is necessary. Migrants, legally or not, come into the EU as a whole. Even if they are legally restricted to one member state, practically speaking there is often little to stop them moving across borders in a border-free Schengen area.

In Panetta’s own home country, the situation is especially bad. Italy’s total fertility rate is now 1.25 as of 2021. This is far below the so-called replacement level of 2.1, which is necessary to keep a country’s population stable. The only thing stopping its population from cratering is the immigration it receives already. Even if the government could stumble on a way to increase the total fertility rate to replacement level, something virtually no developed country has managed, there would still be inertia.

This basic demographic reality is acute in Italy, but not unique to it. The only countries mitigating it so far are those that accept high numbers of immigrants and integrate them into the workforce, like the UK, Spain, and Portugal. Yet it is something politicians skirt around, for fear that their voters are not prepared to hear the truth.

What you end up with is a worst-of-both-worlds situation. Politicians, especially if they act on their own and not on the EU level, cannot get a handle on irregular migration and asylum-seekers, despite repeatedly promising to. All they accomplish is raising the issue’s salience, while driving disillusioned voters to the far-right.

But on the other hand, they dodge the other side of the coin, the need to accept and properly integrate migrants to keep demographic, and fiscal, balances stable. Until governments are prepared to acknowledge these trade-offs, we should be wary of the feasibility of any commitments they make to consolidate public finances in the long term.

US Fertility Rate

The lead image is from MacroTrends.

The following snip is from VOX.

In the US, the birth rate has been falling since the Great Recession, dropping almost 23 percent between 2007 and 2022. Today, the average American woman has about 1.6 children, down from three in 1950, and significantly below the “replacement rate” of 2.1 children needed to sustain a stable population. In Italy, 12 people now die for every seven babies born. In South Korea, the birth rate is down to 0.81 children per woman. In China, after decades of a strictly enforced one-child policy, the population is shrinking for the first time since the 1960s. In Taiwan, the birth rate stands at 0.87.

The US numbers from VOX are a bit low. The lead chart is more current but I like the VOX discussion. Were it not for immigration, the US population would be in decline.

Is that necessarily a bad thing? At what point does increasing population become a Ponzi scheme due to the energy and food needs?

There are a lot of questions and the only thing everyone seems to agree on is that uncontrolled migration is bad. Even Biden admits that, but he is unwilling to do anything about it.

Progressive Irony

Progressives want open borders but they also want guaranteed living wages, clean energy, slave reparations, a right to shelter, a right to free health care, and net zero carbon. The goals are incompatible.

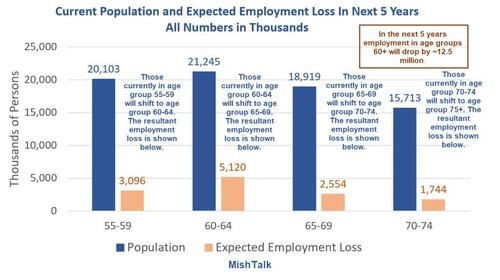

In the next 5 years employment in age groups 60+ will drop by ~12.5 million

On March 21, I commented In the next 5 years employment in age groups 60+ will drop by ~12.5 million

Due to age demographics, I expect employment in age groups 60 and over to decline by about 12.5 million. Let’s go over the math to see how I arrived at that number.

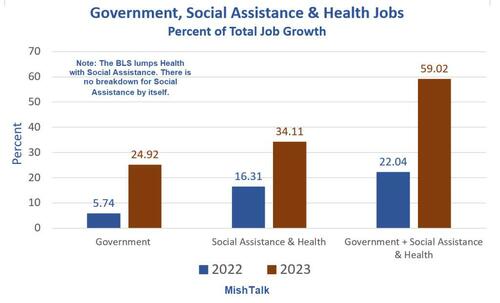

Government + Social Assistance Accounted for Nearly 60% of Job Growth in 2023

On January 5, I noted Government + Social Assistance Accounted for Nearly 60% of Job Growth in 2023

The welfare state is booming along with social assistance for illegal immigrants.

Family Formation

Taking a step back from immigration policy, why is it that family formation is so low? The unfortunate answer is Fed policy and fiscal policy is so inflationary, that young adults have come to expect they will be worse off than their parents.

If so, and that seems accurate, this will be the first time in US history.

Importantly, houses are too expensive. Zoomers and younger millennials are angry over housing costs. And millions of illegal immigrants need a home and services.

Rent is so expensive and anger so high over housing costs that People Who Rent Will Decide the 2024 Presidential Election

Finally, a recurring theme: The Fed’s Big Problem, There Are Two Economies But Only One Interest Rate

The Fed is largely responsible for the housing mess and Biden/Congress is responsible for the rest.

Yet Biden refuses to do anything lest he upset the Progressives who want open borders, guaranteed living wages, clean energy, a right to shelter, a right to free health care, and net zero carbon.

Authored by Stephen Katte via The Epoch Times,

Dr. Anthony Fauci is locked in to testify before the Select Subcommittee on the Coronavirus Pandemic on June 3, his first public hearing since retiring as the president’s chief medical advisor in 2022.

Subcommittee Chair Brad Wenstrup (R-Ohio) announced in an April 24 press release that Dr. Fauci agreed to appear late last year.

“Retirement from public service does not excuse Dr. Fauci from accountability to the American people,” Mr. Wenstrup said.

“On June 3, Americans will have an opportunity to hear directly from Dr. Fauci about his role in overseeing our nation’s pandemic response, shaping pandemic-era policies, and promoting singular questionable narratives about the origins of COVID-19.”

Dr. Fauci testified in a closed door hearing in January.

According to Mr. Wenstrup, Dr. Fauci has already admitted “to serious systemic failures in our public health system,” which he says deserves “further investigation.”

Mr. Wenstrup says among other revelations, Dr. Fauci has said the six feet apart social distancing guidance, recommended by federal health officials and used to shut down small businesses across the country, “’sort of just appeared,” and was likely not based on scientific data.

During the two-day January hearing, Dr. Fauci revealed he signed off on every foreign and domestic NIAID grant without personally reviewing the proposals.

He also admitted that America’s vaccine mandates, which he promoted, could increase the public’s vaccine hesitancy in the future.

Lab Leak—Not So Far-Fetched

At the same time, Dr. Fauci said the lab leak hypothesis around COVID-19’s origins might not be a conspiracy theory, despite his previous very public assertions that it was.

The lab leak theory claims that SARS-CoV-2, the virus that causes COVID-19, was developed at the Wuhan Institute of Virology (WIV) and was accidentally leaked. In the years since COVID first appeared, this hypothesis has been gaining steam, with even the former head of the Chinese Center for Disease Control and Prevention (China CDC) saying it can’t be ruled out as an option.

Mr. Wenstrup claimed that during the previous hearing, Dr. Fauci said he “did not recall” specific COVID-19 information and conversations relevant to the Select Subcommittee’s investigations over 100 times.

A full transcript is expected to be released before the public hearing in June.

Mr. Wenstrup believes the testimony shared so far “raises significant concerns about public health officials and the validity of their policy recommendations during the COVID-19 pandemic.”

“We also learned that he believes the lab leak hypothesis he publicly downplayed should not be dismissed as a conspiracy theory,” he said.

“As the face of America’s public health response to the COVID-19 pandemic, these statements raise serious questions that warrant public scrutiny,” Mr. Wenstrup added.

Following Dr. Fauci’s hearing, the select subcommittee will also hold a public hearing with EcoHealth Alliance president Dr. Peter Daszak on May 1.

Mr. Wenstrup said it “will serve as a crucial component of our investigation into the origins of COVID-19 and provide essential background ahead of Dr. Fauci’s public hearing.”

“We look forward to both Dr. Fauci’s and Dr. Daszak’s forthcoming and honest testimonies, and appreciate their willingness to voluntarily appear before the Select Subcommittee for public hearings.”

The US military's ambitious project to erect a large pier off Gaza's coast (all within a war zone) to allow maritime shipments of humanitarian aid to Palestinians is off to a rocky start, after new reports that the construction site has come under fire.

UN officials were reportedly present at the location on Thursday when it came under attack by unknown gunmen, forcing the visiting delegation to take cover. Hamas has previously warned that it plans to resist any foreign military entity on Gaza's territory, which would include the US forces constructing the pier. The Israel Defense Forces (IDF) issued a statement blaming Palestinian terrorists for the attack (either Hamas or PIJ/Islamic Jihad), which included the launching of mortars.

"Members of a terror group in the Gaza Strip launched mortars at an under-construction pier for a US-led project to bring aid into the Palestinian enclave yesterday, the military says," as cited in Times of Israel. "The mortar attack occurred as United Nations officials were touring the site with Israeli troops on the coast of central Gaza, the IDF says in response to a query on the incident."

Officials said there were no casualties, but the IDF rushed the visiting UN officials to shelter. The UN subsequently also acknowledged the unprecedented attack on the site.

"The terrorist organizations continue to systematically harm humanitarian efforts while risking the lives of UN workers, while Israel allows the supply of aid to the residents of the Gaza Strip," the IDF added in its statement.

During his March State of the Union address, President Biden formally ordered the Pentagon to conduct an "emergency mission" to expand US humanitarian access to the Gaza Strip using a maritime route. He described that a port will be built by the US military, and will utilize a temporary pier to get supplies from ships to the people of Gaza.

"A temporary pier will enable a massive increase in the amount of humanitarian assistance getting into Gaza every day," President Biden said at the time, calling on Israel to "do its part" be letting more aid into the besieged territory while ensuring that "humanitarian workers aren't caught in the crossfire." That was two months ago.

However, it's looking like the US Army and naval engineers involved in the construction themselves could actually be the ones coming under fire.

Commenting on the latest progress and timeline of the Pentagon project, The Wall Street Journal wrote Thursday:

U.S. troops plan to start assembling a floating pier off the coast of northern Gaza as early as this weekend, American defense officials said, part of a Biden administration effort to open new paths for humanitarian aid ahead of a planned Israeli offensive in the city of Rafah.

Egyptian officials briefed on Israel’s plans for Rafah said Thursday that on-the-ground preparations for a military invasion of the city, where about 1 million Palestinians have sought shelter, could start in the coming days. The heads of the Israeli military and internal security service met with Egyptian officials in Cairo on Wednesday to coordinate efforts, including the evacuation of civilians from Rafah to so-called humanitarian zones in other parts of Gaza.

Earlier this month, USAID director Samantha Power said that famine already exists in some parts of the Gaza Strip. WSJ underscored this as well in its fresh reporting: "Some U.S. officials have said the pier, which will float several miles off Gaza’s shore, will help get more aid into northern Gaza, where some residents are already living in famine-like conditions, according to estimates released last month by the Integrated Food Security Phase Classification, an international initiative tasked with assessing the risk of famine around the world."

Critics of Biden's pier plan say it's already too-little-too-late and that the inspection process will still hold up maritime shipments regardless...

Biden's two-month project to build a pier for Gaza – while the population starves – is likely to make aid delivery worse, it is now revealed.

— Jonathan Cook (@Jonathan_K_Cook) April 24, 2024

Not only is Israel insisting that it inspect (meaning delay) aid before it can be loaded on to ships in Cyprus. It's also now insisting… pic.twitter.com/8fUv27kh0d

US soldiers are expected to construct the pier and launch it from aboard US Navy vessels offshore. Vice Adm Kevin Donegan, the most senior US Navy commander in the Middle East has said the plan is "absolutely executable." The Pentagon has previously sought to emphasize that "The current plan doesn't include any US boots on the ground in Gaza." But Hamas is likely to disagree, and could mount continued attacks while Pentagon forces work to complete the major project.

Iranian military commanders and high-ranking officials have warned they could change their approach in developing the country’s nuclear program after increasing tensions with Israel, implicitly announcing their readiness to take it into a military phase.

Before the recent direct military confrontation with Israel, Iran had always insisted that its nuclear program solely had peaceful goals. This stance dramatically changed in recent weeks. Javad Karimi Qudousi, a member of the Iranian parliament's National Security and Foreign Policy Commission, on Monday implicitly claimed that Iran was only one week away from its first nuclear weapon test. The lawmaker wrote on X: "If the order is issued, it will be one week before the first test."

Karimi Qudousi did not mention Ayatollah Ali Khamenei, but such an order would come from supreme leader who has a final say in all matters in Iran.

On Tuesday, in two videos posted on X, he stressed that the targets of Iran’s potential military nuclear program would not only be Israel but also European countries supporting Tel Aviv.

Moreover, hours after the Israeli attack on an air force base in Isfahan last Friday, Ahmad Haqtalab, the commander of the Nuclear Centers Protection and Security Corps, suggested the same idea. "It is possible and conceivable to revise the nuclear doctrine and policies of the Islamic Republic of Iran and deviate from previous considerations," he was quoted as saying.

On Monday, the Javan daily, affiliated with the Islamic Revolutionary Guard Corps (IRGC), highlighted Haqtalab’s remarks, adding "Israel has taken this threat seriously and retreated from their [aggressive] stances."

Teacher given 11 years for teaching Kurdish language

A teacher in the Kurdish regions of Iran has been handed an 11-year prison sentence by the Islamic Revolutionary Court for his role in establishing a cultural centre where the Kurdish language was taught, local media reported.

Soma Pourmohammadi, a Kurdish language educator and a board member of the Nozhin cultural and social organisation in Sanandaj, received the lengthy sentence along with exile in two separate cases.

According to the verdict delivered on Saturday, he was convicted of "forming groups and factions with the intention of disrupting the security of the country" and given a 10-year prison term and exile to Kermanshah prison.

Prior to this ruling, another court had sentenced Pourmohammadi to one year suspended imprisonment for "disturbance of public order".

The Nozhin Social-Cultural Association, an independent cultural group, has been actively engaged in various cultural endeavors over recent years, including conducting free Kurdish language classes in different Kurdish cities.

Despite several languages such as Kurdish, Turkish, and Balouchi being spoken in different parts of Iran, Farsi remains the country's only official language.

https://t.co/hudKW8YQLk

— Charlie (@Charlie007Girl) April 25, 2024

UN nuclear chief: Iran is just weeks away to have enough enriched uranium to make a nuclear bomb

Private jet imports spark controversy

While government authorities have banned the import of many goods, such as expensive mobile phones, due to the economic crisis, the import of private jets has become the center of public attention.

Focus on the issue began when the head of the Civil Aviation Organisation, Mohammad Mohammadi Bakhsh, told the Ilna news agency: "The purchase and sale of seven-seater jet planes is open to the public. Many people are currently utilizing this option, including businessmen, officials, sports teams, and economic teams."

The announcement sparked a widespread backlash in local media, with both reformist and conservative outlets criticizing it.

On Monday, the pro-reformist daily Etemad published an article under the headline: "Goods for those who are better than us," questioning why the purchase and sale of private jets was permitted for a select class amid the country’s economic crisis.

"Why, in the current tight currency situation where many goods are categorized as 'luxury' and importation is prohibited, is the purchase and sale of private jets unrestricted for a privileged few? This perpetuates inequality in society," said the daily. The newspaper also demanded transparency, urging authorities to disclose the names of individuals who own private jets.

Rokna, another Farsi-language media outlet, characterized the publication of this news as emblematic of the profound social class divide. "While the purchase and sale of jet aircraft has been liberalized, the general public lacks the means to afford even a domestic car," Rokna highlighted.

A New York Court of Appeals has overturned Harvey Weinstein's 2020 conviction on felony sex crime charges, for which he was sentenced to 23 years in prison.

In a 4-3 decision, the court found that the trial judge in the disgraced mogul's case had made a critical error, allowing prosecutors to call a series of women as witnesses who said that Weinstein had assaulted them, but whose accusations weren't part of the charges against him, the NYT reports.

In 2020, Lauren Young and two other women, Dawn Dunning and Tarale Wulff, testified about their encounters with Weinstein under a state law that allows testimony about “prior bad acts” to demonstrate a pattern of behavior. But the court in its decision on Thursday said that “under our system of justice, the accused has a right to be held to account only for the crime charged.”

...

Citing that decision and others it identified as errors, the appeals court determined that Mr. Weinstein, who as a movie producer had been one of the most powerful men in Hollywood, had not received a fair trial. The four judges in the majority wrote that Mr. Weinstein was not tried solely on the crimes he was charged with, but instead for much of his past behavior. -NYT

The decision was determined by one vote on a majority female panel of judges, who in February held a searching public debate over the fairness of the original trial.

Weinstein was convicted of raping aspiring actress Jessica Mann at a DoubleTree hotel in 2013 when she was 27-years-old, and forcing oral sex on former production assistant Mimi Haleyi, then 28, at his apartment in 2006.

Now, Manhattan DA Alvin Bragg, who's currently prosecuting former President Donald Trump, will have to decide whether to seek a retrial of Weinstein - who remains in an upstate prison in Rome, NY at the moment. It's unclear how the decision will affect his future. In 2022, he was convicted by a California court of raping a woman in a Beverly Hills hotel and sentenced to 16 years in prison. The jury found Weinstein guilty of rape, forcible oral copulation, and sexual penetration by foreign object involving a woman known as Jane Doe 1.

The 2022 jury acquitted Weinstein of a sexual battery charge made by a massage therapist who treated him at a hotel in 2010, and was unable to reach a decision on two allegations, including rape, involving Jennifer Siebel Newsom, the wife of California’s Democratic governor Gavin Newsom. She was known as Jane Doe 4 in the trial, and had testified to being raped by Weinstein in a hotel room in 2005.

Weinstein was convicted of sexually abusing over 100 women - and was convicted of assaulting two of them in the New York case.

"That is unfair to survivors," said actress Ashley Judd, the first actress to come forward with allegations against Weinstein, the NYT's Jodi Kantor reports. "We still live in our truth. And we know what happened."

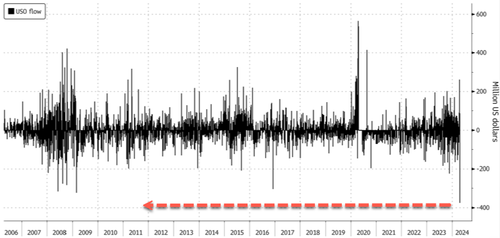

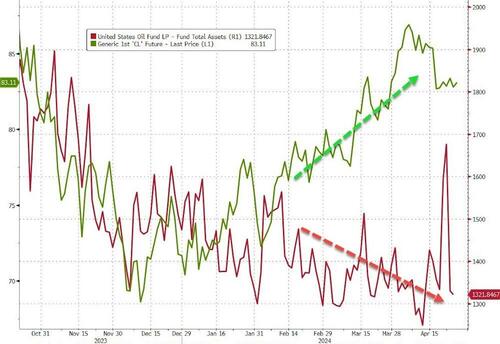

A reduced geopolitical risk premium for Brent crude this week is likely one of the main drivers resulting in the largest daily outflows for the US Oil Fund ETF. Tensions between Iran and Israel have subsided in recent days, and it's entirely possible the White House is busy mediating both sides to ensure a wider conflict doesn't rocket Brent prices above $100/bbl.

Bloomberg data shows that the US Oil Fund experienced the most massive daily outflow ever on Tuesday, with investors pulling a record $376 million, exceeding the outflow of $323 million set in 2009. Though as the chart below shows, there was a huge inflow just a day or two ago...

"The timing of this activity coincides with a general easing of immediate tension in the Middle East over the weekend," John Love, chief executive officer of USCF Investments, told Bloomberg. USCF Investments is the firm that manages USO.

What happened here? USO's total assets decoupled and negatively diverges from oil prices (a similar picture to what we have seen in gold as physical demand soars as paper demand ebbs).

Love said, "Given how high tensions were prior to the strike, it's likely this was an event-driven selloff."

Brent crude prices topped $91/bbl in early April and traded above the $90/bbl level through the mid-point of April as Iran and Israel volleyed missiles and bombs at each other in an unprecedented escalation between the two countries. However, the turmoil appeared more or less theatrics than anything else. Prices have since faded to the $87-$88/bbl level.

"Brent crude oil prices have retreated from their recent highs following a perceived de-escalation in the Israel-Iran conflict, and we continue to expect prices to remain range-bound over the coming months given current fundamentals," Goldman's Jenny Grimberg wrote in a note to clients on Wednesday.

Grimberg shifted up her Brent price floor to $75bbl from the previous line of $70/bbl to reflect OPEC's increasingly strong influence on the market, softening US supply, a more robust demand outlook, and ongoing geopolitical risks. She also adjusted her price forecasts for 2H24/2025 to $86-$82/bbl (from $85-$80/bbl).

"That said, we maintain our $90/bbl ceiling on prices, owing partly to ample OPEC+ spare capacity, which limits upside price risk," she added.

On Thursday, in a separate note, MUFG Bank's Ehsan Khoman outlined a "reduced geopolitical risk premium" impacting Brent prices but said, "a broader risk-off tone is being overshadowed by bullish US crude inventory numbers, with front-end Brent pricing consolidating below the USD90/b handle."

Khoman pointed out that oil bulls are sitting comfortably with prices over the 50-day moving average of $86/bbl.

He expects Brent to trade between the $80/bbl and $100/bbl range for the rest of the year primarily because of "effective OPEC+ market management" on the supply side, adding that the lingering risk remains geopolitics in the Middle East.

That said, the largest USO daily outflow ever is likely not an ominous sign of a major trend change in crude prices but rather just a cooling of the geopolitical risk premium. A combination of lingering threats in the Middle East and OPEC+ market management will keep prices elevated.

Authored by Peter C. Earle via The American Institute for Economic Research,

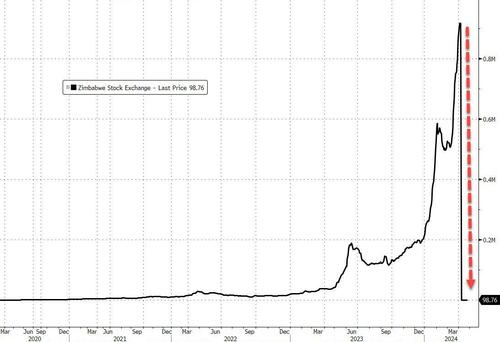

Zimbabwe’s historical relationship with money has been inundated with mistakes, recklessness, and hardship. During the peak of its 2008 hyperinflation, the nation experienced a catastrophic economic downturn, characterized by the issuance of billion- and trillion-dollar banknotes that were, despite their nominal enormity, virtually worthless. Recent economic challenges have revived painful memories of that era with the resurgence of inflation (currently at 55 percent), a return to the US dollar, euro, and South African Rand as de facto currencies, and the necessity of using large physical stacks of bills to purchase basic commodities like bread and eggs.

On April 5, a new currency was announced.

Later this month, the ZiG (Zimbabwe Gold) will replace the current monetary unit, the Zimbabwean Real Time Gross Settlement dollar (RTGS). The ZiG marks a sixth attempt by the Zimbabwean government and central bank to introduce a currency unit that sets its monetary house in order.

Upon declaring independence in 1980, the Reserve Bank of Zimbabwe (RBZ) issued the original Zimbabwe dollar (ZWD) to replace the Rhodesian dollar at par (1:1). Over the subsequent two decades, the money supply expanded amid fiscal mismanagement, policy errors, and authoritarian governance. Denominations of the ZWD grew from two, five, and 10 ZWD denominations into bills marking hundreds, thousands, and millions of units, each with precipitously dissipating purchasing power.

In August 2006, the first attempt to reform the original ZWD was undertaken.

The RBZ recalled outstanding currency notes, replacing them with redenominated notes of one one-thousandth the value of the previous notes by slashing three decimal places.

Roughly two years later, in August 2008, a second redenomination marked the third ZWD reissue, this time slashing ten decimal places.

By this point, prices were at least doubling on a daily basis. Thus did each ten billion ZWD note become one ZWD to address the increasingly unwieldy terms of face-to-face market transactions. The apex of the hyperinflation was reached with the issue of the 100 trillion ZWD banknote, after which in February 2009 — barely six months later the previous redenomination — twelve zeros had to be removed from currency units. This was the fourth ZWD issue. By this point, the 1980 ZWD had been whittled down to one-sextillionth (0.000000000000000000001) of its initial value. Errors in simple transactions became commonplace, with both calculators and computers unable to handle fundamental accounting operations. Agriculture, a difficult commercial undertaking even with a stable currency, is all the more challenging when consummated in units usually reserved for astronomers.

By the end of 2008, 28 years of inflation topped a total 231 million percent.

The ZWD was demonetized in 2009, with the Euro, the South African Rand, and the US dollar as well as smaller, regional currencies supplanting it.

In 2015, that process was completed, with every 35 quadrillion ZWD presented at a bank being retired for a single US dollar.

Alongside a wide array of currencies in use throughout the next few years were Zimbabwean government bond notes.

In 2019, the Real Time Gross Settlement (RTGS) dollar was issued, but quickly ran into trouble — even before the COVID pandemic broke out. Inflation followed yet again, and the use of international currencies — which had been outlawed upon the introduction of the RTGS — was again legalized. When issued, the RTGS was set at an official exchange rate of 2.5 per US dollar. Since the start of 2024, though, it has lost 80 percent of its value, recently trading at 30,671 per US dollar. At this rate of inflation, an item that cost $100 US dollars in 1980 would have cost over $700 billion dollars by 2023.

USD-ZIM/RTGS exchange rate (2022 – present)

(Source: Bloomberg Finance, LP)

On April 30, 2024, RTGS units will be exchangeable for ZiG as the new coins and bills begin circulating. RBZ Governor John Mushayavanhu has announced the initial exchange rate for the ZiG at 13.56 per US dollar, with subsequent rates to be determined through interbank markets. Hopes for the success of the ZiG are underpinned by a reputed $185 million worth of gold and other reserves backing it. There are practical hurdles, though.

The sustainability of a gold-backed currency like ZiG is uncertain considering the limited extent of Zimbabwe’s physical gold reserves relative to the desired exchange rate. Moreover, the absence of concurrent measures from its trading partners leaves the new currency susceptible to fluctuations in gold prices. Black markets, which speak truth to a fault, are registering doubt.

And investors in the Zimbabwe Stock Exchange in Harare have made no secret whatsoever about their cynicism, sending stock prices down 99 percent in several hours after the ZiG announcement.

Zimbabwe Stock Exchange (Jan 2024 – present)

(Source: Bloomberg Finance, LP)

Zimbabwe still relies upon printing money to finance its budget deficits. Although Mushayavanhu has adamantly pledged to avoid this practice, at the onset the ZiG faces an uphill battle to claim public trust, given nearly a half century of monetary disasters. Moreover, the government’s insistence on accepting payments for certain services exclusively in US dollars, such as road toll fees and passport processing, is undermining confidence in the new money even before it begins changing hands.

Reports indicating that the government will require tax payments in mixed currency are further dimming prospects for the ZiG’s acceptance and viability.

The Zimbabwean government has, in addition, associated the latest monetary project with the global dedollarization movement. While there remains a possibility for the ZiG to outperform its predecessors, the country’s tumultuous economic history, transitioning from hyperinflation to hyper-dollarization and currently grappling with double-digit inflation and interest rates, underscores deep-rooted issues beyond mere monetary policy, including governance deficiencies and corruption risks. Ruinous policies which have destroyed the productiveness of the nation’s economy, as well as the classic blame-mongering of businesses for the rising general price level (something Americans have borne witness to recently as well) have been commonplace. Without comprehensive fundamental reforms addressing these systemic challenges, Zimbabwe risks perpetuating its reliance on emigration as a coping mechanism alongside the enduring symbol of its economic turmoil, the multi trillion-dollar banknote. The efficacy of any monetary system, whether a commodity standard or any other, hinges singularly upon the integrity and competence of its custodians.

Dissipated Zimbabwean cash is thumbtacked to many a bulletin board, and fetches many more US dollars in exchange on eBay than it ever did in its circulatory prime. The trinketization of that money, however, has come at great human cost. According to the US Agency for International Development, a staggering 63 percent of Zimbabwean households endure poverty, with one in eight experiencing extreme deprivation. That juxtaposes with the nation’s abundant mineral resources, spanning over 40 distinct minerals: platinum group metals, gold, coal, lithium, and diamonds among others. Despite that potential wealth, the realization of economic advancement remains contingent upon substantive political reforms.

Even the most faithfully implemented commodity-backed money standard is fundamentally predicated on the integrity and competence of its overseers. Successive waves of spectacular currency destruction speak to a deeper illness in economic and political institutions, strongly alluding to systemic vulnerabilities. One hopes, for the sake of the long-suffering citizens of Zimbabwe, that this time around the result of yet another monetary reconstitution is successful, fostering a stable general price level, a reliable monetary unit for saving and spending, and enhanced possibilities for economic calculation. Without fundamental changes guaranteeing private property protection, pro-market reforms, and safeguards against corruption, though, the ZiG is likely to retrace the unfortunate steps of its predecessors.

After two and a half hours, the Supreme Court has finished hearing arguments on whether a former president is immune from criminal prosecution.

Reading the tea-leaves of the comments has left most believing that SCOTUS will fail to grant former President Trump the full immunity he is seeking (choosing instead to narrow the protections for former presidents), but are likely to issue a ruling that could further delay his trial on charges of conspiring to overturn the 2020 election.

That would be a partial win for the former President.

As Axios reports, a definitive ruling against Trump - a clear rejection of his theory of immunity that would allow his Jan. 6 trial to promptly resume - seemed to be the least likely outcome.

-

A majority of the justices seemed inclined to rule that former presidents must have at least some protection from criminal charges, but not necessarily the "absolute immunity" Trump is seeking.

-

The core distinction during oral arguments came down to a president's official vs. unofficial actions. — and which of Trump's efforts to overturn the 2020 election results were official vs. unofficial.

-

The most likely outcome might be for the high court to punt, perhaps kicking the case back to lower courts for more nuanced hearings.

That would still be a victory for Trump, as Sam Dorman reports via The Epoch Times that the outcome of this appeal could delay lower court proceedings in President Trump’s Washington trial as well as his cases in Georgia and Florida. It’s unlikely that the Supreme Court, which is expected to release a decision in June, will write an opinion that delays his ongoing criminal “hush money” trial in New York.

The bottom-line is that no clear, concise majority opinion emerged this morning.

But there may be five justices willing to kick the can down the road - and that's enough for Trump, at least for now.

* * *

The Supreme Court will hear oral argument today over former President Donald Trump’s claim that he’s immune from criminal prosecution for official acts he undertook while in office.

Listen live here (due to start at 1000ET):

LISTEN LIVE: Supreme Court hears case on whether Trump has presidential immunity from prosecution

— PBS NewsHour (@NewsHour) April 25, 2024

https://t.co/zGSnfhqCJq

Jonathan Turley is live-blogging the hearing on X:

We are off and running on the oral arguments on immunity with John Sauer, former Scalia clerk, arguing for the former president.

...Chief Justice Roberts asked the most poignant question. What if a president appointed an ambassador (a clearly official act) but does so for a bribe? Sauer offered a nuanced point that the bribe itself would not be an official act...

...Justice Sotomayor just hit Sauer and said that Trump was only acting for personal gain and not in the interests or in a function of his government. She is making the slippery slope argument that such immunity would protect the assassination of a president...

...Justice Jackson said that "every president from the beginning of time" understood that they could be prosecuted but they "have continued to function and do their job."...

...Sauer agrees that a president can be prosecuted for private conduct. His point is only that the motivations of official conduct should not be the inquiry of the court. He is doing a good job in maintaining a more nuanced position before the Court...

Justice Jackson gets embarrassed by Trump lawyer John Sauer when she tries to describe America where the president has immunity:

— Greg Price (@greg_price11) April 25, 2024

“The regime you've described is the one we've operated under for over 234 years.” pic.twitter.com/yo15zSUkhA...Justice Alito is asking whether the "robust form of immunity" that he is presenting is really necessary. Alito is exploring the middle ground that some of us have previously discussed...

...Sauer responded again about the danger of allowing motivations to be pursued. Alito suggests that they may insist on objective, not subjective, grounds in making the key determination -- on "purely objective grounds" to determine if this is an official function or issue...

...Interestingly, Alito seems to have answered Sotomayor on a hypothetical in dealing with the term "plausible" . . . an early preview of the conference!

HAHAHA: Justice Alito Exposes Flaws in D.C. Court Opinion Being Used Against Trump After Special Counsel Attorney Claimed Grand Juries Are Layers Of Protection, Says That May Not Be True Since Even Ham Sandwiches Aren't Safe from Grand Jury Indictments! LISTEN pic.twitter.com/ueYZXcdN0r

— Simon Ateba (@simonateba) April 25, 2024... Justice Thomas just asked Sauer if he is challenging the constitutionality of the Special Counsel. Sauer said that they have not come so in this case.

...Sotomayor just referred to the alternative electors as "fake" and Sauer pushed back on the language of the indictment on the record for decision...