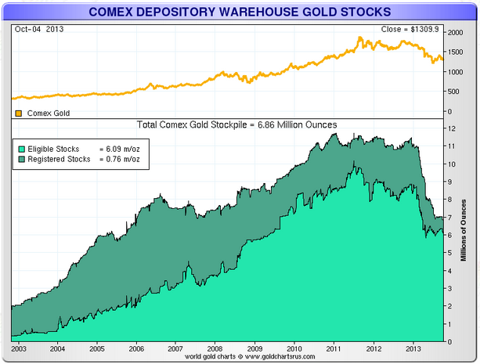

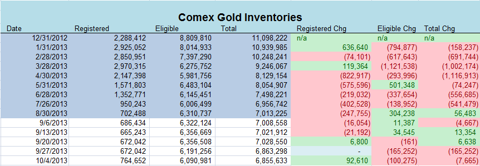

Last week was a fairly quiet week in terms of COMEX gold inventories, but that quietness was broken by an extremely large withdrawal of over 160,000 on one day, which led to a large fall in total gold inventories for the week. This week the quietness returned and the only major thing to note was a large transfer of gold from eligible to registered status, though we did hit a new cyclical low for total COMEX gold inventories and we are currently at 2005 levels of inventories.

Keeping track of COMEX inventories is something that is recommended for all serious investors who own physical gold and the gold ETFs (GLD,PHYS, and CEF) because any abnormal inventory declines may signify extraordinary events behind the scenes that would ultimately affect the gold price.

Source: http://www.sharelynx.com

We will take a closer look at these numbers, but let us first explain the COMEX a little more for investors who are unfamiliar with it.

Introduction to COMEX Warehousing

COMEX is an exchange that offers metal warehousing and storage options for its clients. The list of their silver warehouses can be foundhere and their gold warehouses can be found here. In the case of silver and gold, the metal is stored at these official warehouses on behalf of banks and their clients and can be used to settle futures contracts, transferred between clients, or withdrawn from the warehouse. This offers large holders of precious metals a convenient way to store their metal with minimal storage fees – very convenient indeed if you hold large amounts of gold or silver and you don’t want to store them in your basement.

Silver and gold stored in these warehouses can fall into two categories: Eligible and Registered.

Eligible metals are those that conform to the exchange’s requirements of size (1000 ounce bars for silver and 100 ounce bars for gold), purity, and refined by an exchange approved refiner. Eligible metals are stored at COMEX warehouses on behalf of banks or private parties, but are not available for delivery for a futures contract.

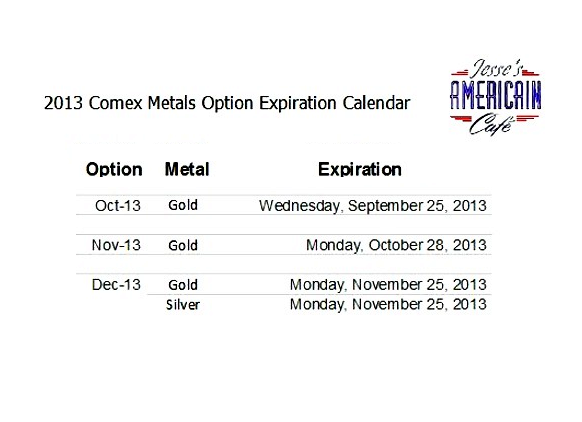

Registered metals are similar to eligible metals except that these metals are also available for delivery to settle a futures contract. COMEX issues a daily report on gold, silver, copper, platinum, and palladium stocks, which lists all the metal that is currently stored in COMEX warehouses and how much eligible and registered metal is present.

This information allows investors insight into how much metal is currently backing COMEX futures contracts, what large gold and silver owners are doing with their metals, and how many clients are requesting delivery of their metals. There is a lot more to glean from this information but for the purpose of this article we will focus on the gold drawdown.

This Week’s Changes: Large Transfer Increases Registered Gold While Total Gold Continues to Drop

Let us now take a deeper look at the gold draw-downs being seen in the COMEX warehouses.

Last week we saw a large transfer of eligible gold to registered status (making it eligible for delivery) in the JPMorgan warehouse, but total gold held at COMEX warehouses continued to fall for the week and ended the week 7,665 ounces lower.

Registered gold increased by a large amount for the week because of this transfer but, as investors can see in the chart below, the long-term view is this was merely a blip in a continuing decline of registered gold inventories.

Read the full article at Seeking Alpha

—