With all eyes glued to the political wrangling in Washington, and the impact of the government shutdown that took effect this morning, attention has been diverted from some very bullish developments in the palladium market.

The price of the metal has struggled for direction most of this year oscillating between $650/ounce and $750/ounce amid a wider selloff of precious metals driven by concerns about the U.S. scaling back stimulus and a struggling global economy. With a focus on market fundamentals, we believe palladium has the potential to fulfill earlier expectations of robust gains this year. Palladium has already outperformed other precious metals so far this year with gold down 20%, silver down 28% and platinum down 8%, palladium is the only bright spot appreciating by 3% on a year-to-date basis. Palladium has successfully detached itself from the other precious metals and given recent events we think this divergence will continue.

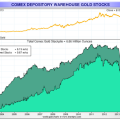

To truly understand how investors have taken to palladium this year, some market figures will be helpful for context. According to Johnson Matthey, total palladium supply in 2012 was 6,545,000 ounces and investor demand was just 385,000 ounces or about 5% of the market. As you can see, historically investors have not been big participants in this market.1 For 2013 the analysts we follow have forecast investor demand between 100,000 and 500,000 ounces. So far in 2013 the palladium ETF’s have already purchased 339,000 ounces of palladium, which puts them well on track to exceed last year’s investments. The other statistic that is helpful to gauge interest is futures volume which has experienced all-time highs this year representing well over half of the total mine supply of the palladium market. Now, it remains to be seen if investors will choose to convert these paper ounces to metal, but if even a small fraction of investors take delivery it could have a material impact on the price of palladium. The bullish market developments have come fast and furious for palladium recently.

This past Friday Norilsk, the single largest producer of palladium, reiterated their bullish view of the PGM market. “We see a palladium deficit of 1 million ounces for 2013 and a platinum deficit of 500,000 ounces” They further suggested that palladium stockpiles at Russian state repository Gokhran are probably exhausted, and not affecting the market anymore. Students of the market will know that the Russians had a large store of palladium that they were selling on to the market. The limited imports/exports of palladium through Switzerland in August seem to confirm Norilsk’s statements.2 Anton Berlin, marketing director at Norilsk Nickel unit ZAO NormetImpex, added that Norilsk is “very optimistic” about platinum and palladium prices and as South Africa cuts output, the current market deficit will grow. For perspective a 1,00,000 ounces deficit in the market represents 15% of annual mine supply of the metal.3 This suggests that there is a 15% ‘hole’ in the palladium market supply this year.

Read the full article at: http://www.sprottgroup.com/thoughts/articles/palladiums-future-is-bright/