Published on Nov 13, 2013

**I am determined to help you make money FOR FREE!

click here: http://traderschoice.net

**Check out Liberty Mastermind Symposium, click here:http://libertymastermind.us/

Published on Nov 13, 2013

**I am determined to help you make money FOR FREE!

click here: http://traderschoice.net

**Check out Liberty Mastermind Symposium, click here:http://libertymastermind.us/

Published on Nov 11, 2013

*Link to USAWatchdog Interview: http://usawatchdog.com/fed-will-incre…

**I am determined to help you make money FOR FREE!

Click here: http://traderschoice.net

Published on Oct 29, 2013

Questions on hedging physical or trading gold and silver please call or email me! See my information below: (click on show more below)

E-Mail: jim.comiskey@archerfinancials.com

Toll-Free: 1-888-935-7979

Outside Line: 1-312-242-7996

If you want to donate money for equipment, software, appreciation, or to buy us some beer, please do so via PayPal to email:

jimcomiskeymetals@yahoo.com

Thanks everyone for watching!

If you want Don to help you with posting videos, please contact him at DHBergstrom@gmail.com

Published on Oct 25, 2013

*Link to Wall St. For Main St. Interview:http://www.youtube.com/watch?v=0Y9Sp8…

**I am determined to help you make money FOR FREE!

Click here: http://traderschoice.net

Published on Oct 22, 2013

Peter Schiff on CNBC/Yahoo! Finance (10/17/2013)

Listen to The Peter Schiff Show

Live Weekdays 10am to noon ET on http://www.SchiffRadio.com

Buy my newest book at http://www.tinyurl.com/RealCrash

Friend me on http://www.Facebook.com/PeterSchiff

Follow me on http://www,Twitter.com/PeterSchiff

Marc Faber, publisher of The Gloom, Boom & Doom Report, told CNBC on Monday that investors are asking the wrong question about when the Federal Reserve will taper its massive bond-buying program. They should be asking when the central bank will be increasing it, he argued.

“The question is not tapering. The question is at what point will they increase the asset purchases to say $150 [billion] , $200 [billion], a trillion dollars a month,” Faber said in a “Squawk Box” interview.

The Fed—which is currently buying $85 billion worth of bonds every month—will hold its October meeting next week to deliberate the future of its asset purchases known as quantitative easing.

(Read more: Treasury yields will still spike to 5%: Societe Generale)

Faber has been predicting so-called “QE infinity” because “every government program that is introduced under urgency and as a temporary measure is always permanent.” He also said, “The Fed has boxed itself into a position where there is no exit strategy.”

The continuation of Fed bond-buying has helped support stocks, and the Dow Jones Industrial Average and S&P 500 Index are coming off two straight weeks of gains, highlighted by record highs for the S&P.

While there may be little inflation in the U.S., Faber said there’s been incredible asset inflation. “We are the bubble. We have a colossal asset bubble in the world [and] a leverage or a debt bubble.”

Back in April 2012, Faber said the world will face “massive wealth destruction” in which “well to-do people will lose up to 50 percent of their total wealth.”

(Flashback: ‘Massive wealth destruction’ about to hit: Marc Faber)

In Monday’s “Squawk” appearance, he said that could still happen but possibly from higher levels because of the “asset bubble” caused by the Fed.

“One day this asset inflation will lead to a deflationary collapse one way or the other. We don’t know yet what will cause it,” he said.

—By CNBC’s Matthew J. Belvedere. Follow him on Twitter @Matt_SquawkCNBC.

As the world continues to face great uncertainty, today a man who has been involved in the financial markets for 50 years, and whose business partner is billionaire Eric Sprott, told King World News that he believes “one way or another we are looking at a frightening end to all of this.” He also discussed…

On the heels of an explosive mid-week surge in the price of gold and continued weakness in the US dollar, today the man who predicted the massive mid-week spike in gold ahead of time warned King World News that the West is now collapsing. London metals trader Andrew Maguire also spoke with KWN about what…

CNBC’s Jim Cramer said the U.S. is “a laughing stock around the world, maybe worse than Italy in some ways when I look at benchmarks. We have obviously lost the faith of a lot of countries.”

“If there was a way to be able to take your money out of this country and put it in Germany … if I were Brazil, if I were Japan I would do it immediately,” he said Thursday on “Squawk Box.”

He went on to say that the slumping dollar index, which measures the greenback’s value against a basket of currencies, reflects the current sentiment of investors around the world. They are saying “lets go into gold, lets get out this dollar … lets not be in bonds in the United States, we’d rather be in any other currency because they basically have lost control,” he said.

“There is a notion that there’s a party dissolution, there’s no coming together. … This is a good opportunity—between now and the next wrangle—where you can find a safe haven. Whether it be gold, whether it be the euro, or whether it be, frankly, the Chinese currency,” he said.

The dollar was last down 1.1 percent to 79.64, and off of a one-month high of 80.754 that had been sent on Wednesday.

Many investors believe that the temporary deal to avoid U.S. debt default might prompt the Fed to hold back from reining in it’s massive bond buying program, and may weigh the dollar down further. Cramer noted that the liquidity of the U.S. market is a positive side, but he thinks “the Federal Reserve is in there buying every bond they can right now.”

—By CNBC’s Karma Allen. Follow him on Twitter

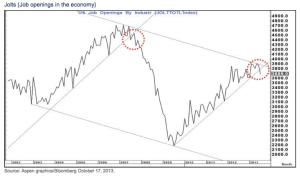

On the heels of some wild trading in global markets, and the Chinese downgrading the US, today top Citi analyst Tom Fitzpatrick sent King World News the scary chart that has everyone in Washington terrified. Fitzpatrick also discusses an incredible price target for gold, along with 3 incredible gold and silver charts he sent KWN.…

By Michael Snyder, on October 17th, 2013 On the global financial stage, China is playing chess while the U.S. is playing checkers, and the Chinese are now accelerating their long-term plan to dethrone the U.S. dollar. You see, the truth is that China does not plan to allow the U.S. financial system to dominate the…

Published on Oct 17, 2013

The Schiff Report (10/18/2013)

To Download my 2005 housing bubble article, click the link belowhttp://www.europac.net/commentaries/r…

To watch the full video of my mortgage bankers speech, click the following link http://www.youtube.com/watch?annotati…

Listen to The Peter Schiff Show

Live Weekdays 10am to noon ET on http://www.SchiffRadio.com

Buy my newest book at http://www.tinyurl.com/RealCrash

Friend me on http://www.Facebook.com/PeterSchiff

Follow me on http://www,Twitter.com/PeterSchiff

“Whatever influence, if any, I have in Washington, I will try to make sure they understand this is extremely damaging to the economy. I think the fourth-quarter results will come in negative. This is as a result of the behavior of Washington.” Oct. 17 (Bloomberg) — Laurence D. Fink, chief executive officer of BlackRock Inc.,…

On the heels of Washington desperately moving to buy more time to deal with its financial crisis, today Canadian legend John Ing warned King World News that China is preparing to unleash the “worst nightmare” for the United States. Ing, who has been in the business for 43 years, also stated that the Chinese are about…