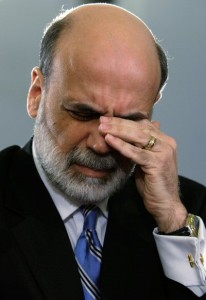

When Ben Bernanke announced that the Federal Reserve’s Open Market Committee was going to continue its monetary expansion program it calls Quantitative Easing, almost everyone in the financial media was taken by complete surprise. According to the mainstream media, the non-taper “surprised almost everyone out there.” Well it did not surprise me, nor anyone who had been paying attention to what I had been saying. As I said repeatedly over the past several months, the Fed knows that the appearance of economic health would evaporate if its stimulus were withdrawn, or even diminished. The Fed understands, as the market seems not to, that the current “recovery” could not survive without the continuation of massive monetary stimulus. In fact, the Fed’s next big move will likely be to increase, rather than taper, its monthly QE dosage! One reporter on this video said that its time for the Fed to take the training wheels off the economy. As I have been saying for years, QE is not the training wheels, its the only wheels the economy has. Take it away and the economy stalls. However, as the economy is now headed toward a cliff, taking the wheels off is much better than leaving them on and going over that cliff.

For more on how I knew the Fed wouldn’t taper, here’s an oped I released after the decision was announcedhttp://www.europac.net/commentaries/t…

Listen to The Peter Schiff Show

Live Weekdays 10am to noon ET on http://www.SchiffRadio.com

Friend me on http://www.Facebook.com/PeterSchiff

Follow me on http://www,Twitter.com/PeterSchiff

Buy my newest book at http://www.tinyurl.com/RealCrash