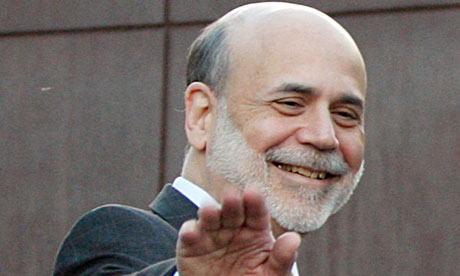

Having allowed a couple of days for the tidal wave of mainstream, post-“tapering” nonsense to subside; it’s now time to look at the facts, as once again The Boy Who Cried Exit Strategy got in front of microphones to say “just kidding.”

At the time that B.S. Bernanke originally began his musings now known as “tapering”; it had already been observed that the U.S. pseudo-recovery was “longer than average duration” – i.e. it was already past its expiry-date. After stalling for 4 ½ years, and failing to deliver on all his previous promises of an “exit strategy” – while the U.S. economy was relatively “strong”(?) and supposedly growing – no rational government (or central bank) would ever time the withdrawal of stimulus to coincide with the end of a growth-cycle.

“Tapering” was always a hoax.

Simply talking about tapering caused interest rates (i.e. borrowing costs) on U.S. ten-year Treasuries to nearly double; and naturally/inevitably those higher borrowing costs filtered through the entire U.S. economy. Thus in simply talking about tapering for seven months; the Banksters created so much economic “drag” on the U.S. economy that if Bernanke had actually, finally delivered on (yet another) “exit strategy” promise, it could have only been interpreted as deliberate economic suicide.

“Tapering” was always a hoax.

There is a delicious irony here. The “latest rounds of QE” – the current, $1 trillion per year of totally gratuitous U.S. money-printing – are not actually “new” money-printing at all. These infinite stacks of Bernanke-bills were being conjured into existence just as quickly before these “announcements”, it simply wasn’t being reported/declared.

It was counterfeit money, in every sense of the word. This was explained in a previous commentary. The original problem? No buyers (anywhere) for U.S. Treasuries – at “all-time record prices”. The solution? Counterfeit money.

Secretly print-up $trillions in counterfeit Bernanke-bills, and use that counterfeit money to “buy” U.S. Treasuries in auctions which (conveniently) had just been made totally opaque. Readers have seen or heard my description of the new-and-improved “Treasuries auction” previously.

A stack of Treasuries is placed on a table. The lights go out. (Sounds of paper-shuffling are heard.) The lights come back on. The stack of Treasuries is gone. “Auction” complete.

This cheap ‘magic trick’ was the Perfect Crime, and then Reality ruined everything. With the U.S. pseudo-recovery already beginning to obviously sag (in its old age); the call went out to the Fed for “more stimulus” – given the fact that the U.S. Treasury is totally empty (save for the IOU’s).

So B.S. Bernanke and Co. simply began reporting the “new money” they had already been counterfeiting previously, and presto! One $trillion per year in new, so-called “stimulus.” Now (suddenly) there was an actual “reason” for U.S. Treasuries to be improbably perched at all-time record prices – despite the fact the U.S. economy is obviously bankrupt: the Federal Reserve was openly monetizing all debt.

“The Truth shall set you free”? Not if you’re a central banker at the Federal Reserve. Then it’s a nasty ball-and-chain which (you discover to your horror) you can never remove.

Read the rest of the story at Bullion Bulls Canada