By Keith McCullough

“In 64 A.D., in a naïve attempt to deceive the populace, Nero decreased the silver content in the coins and made silver and gold coins slightly smaller”

Nero coin (Photo credit: Wikipedia)

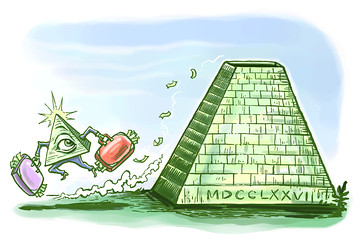

As the quote above reveals, central planners have been clipping coins and devaluing the The People’s hard-earned currency for at least two thousand years. The Roman Emperor Nero of course devalued the Roman currency for the first time in the Empire’s history. What was it that gave both the Roman and Ottoman Empires the audacity to plunder the purchasing power of their people?

After 200 years of operating as an independent bank, what made the British Empire so soft that it felt the need to socialize (nationalize) the Bank of England in 1946? What was the US “Free-Market” Empire and why have we empowered the Fed to change it?

If you disregard the vacuum of history in which Ben Bernanke thinks (the 1930s) and contextualize the moment his Fed currently occupies (within the construct of long-term history, which will ultimately judge Bernanke when he’s long gone), it’s getting scary again. But you probably already knew that. The sad thing is that some of his Fed heads do too.

On Monday, Dallas Fed Head Richard Fisher basically admitted two key things:

- The current White House Administration has politicized the US Federal Reserve

- By not doing what they led the market to believe they would do (taper), the Fed is losing credibility

Check. check.

Read the full article at Forbes