Visit WallStForMainSt’s web site at http://WallStForMainSt.comand find out how you can win FREE silver with no obligations and no purchase necessary!

In this podcast, Wall St for Main St discussed the latest decision from the Federal Reserve to not taper and why they can not pull the plug on QE for a long time. Also, they discussed why the so called “Energy and Manufacturing Renaissance” will not be enough to bring down unemployment.

Another topic that was discussed are the new trends forming in the technology industry such as 3D printing, big data, robotics and automation. They talked about why automation and robotics will bring less jobs back to the U.S. Plus much more!

Links:

http://www.zerohedge.com/sites/defaul…

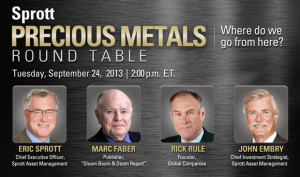

http://www.sprottgroup.com/thoughts/a…

This video was posted with permission fromhttp://WallStForMainSt.com

SUBSCRIBE (It’s FREE!) to “Finance and Liberty” for more interviews and financial insight: http://bit.ly/FinanceAndLiberty

Website: http://FinanceAndLiberty.com

Like us on Facebook: http://facebook.com/FinanceAndLiberty

Follow us on Twitter: http://twitter.com/Finance_Liberty